Cpf housing loan calculator

This promotes financial prudence and prevents over-borrowing. CPF or HDB Housing Grants are given to lower- and middle-income families to help make their home purchases more affordable.

New Cpf Loan Rules May 2019 Property Connected Singapore

For users aged 55-64 the loan is assumed to be repaid.

. Your CPF OA and Cash Savings will be used to finance your flat purchase. It is important that you submit the request for partial capital repayment via My HDBPage. Interest Rate per annum eg.

For the bank loan after 55 yo can I use the OA and SA to pay for the bank loan. The loan interest rate is 260 per annum. Take the current CPF Ordinary Account interest rate and add 01 to it.

The amount above the BHS will flow to your Special or Retirement Accounts to increase your monthly payouts. This is the maximum loan amount that can be issued to you for a particular propertyIts expressed as a percentage of the propertys market value. Singapore has a dynamic property market.

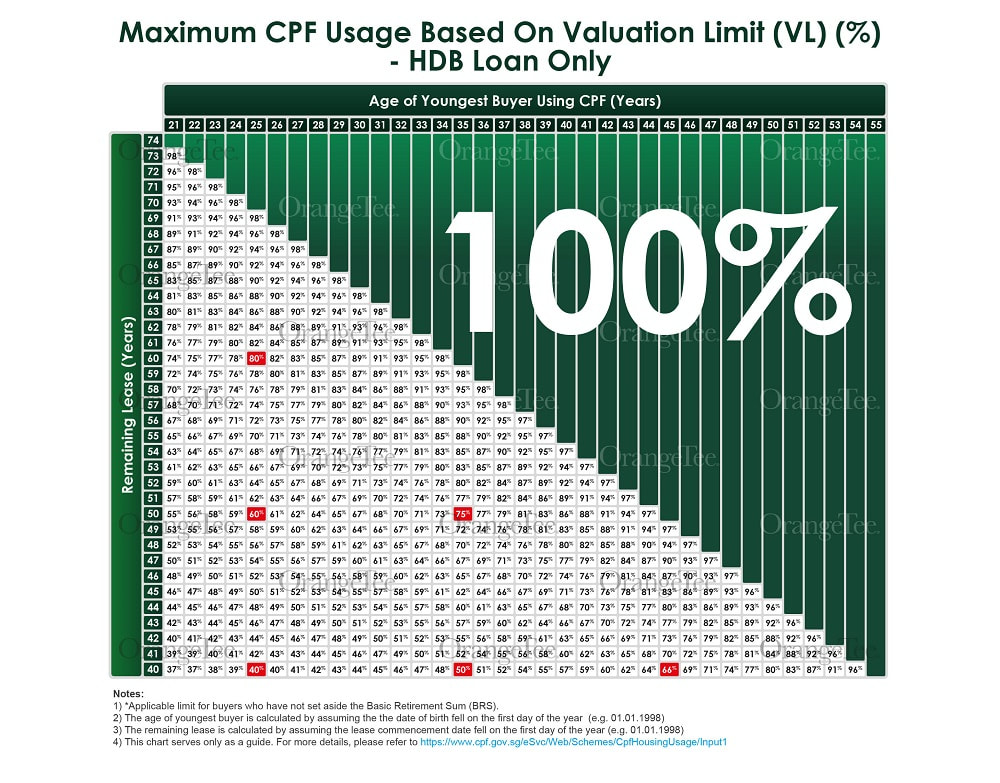

07 Jan 2021 Location map nearby amenities and site view are updated. Buyer can use CPF to pay for the property up to the HDB Valuation Limit. Govt valuation is Rs 1993200-.

Want to take new housing bank loan now and do a deferred payment. This is the current HDB housing loan concessionary interest rate. 02 Jan 2021 Welcome to Tenet EC website.

88000 for members who turn 55 in 2019. Upon logging in look under Other Related Services - Housing Loan Interest Calculator. CPF housing usage calculator Estimate how much Ordinary Account savings you can use for a property purchase.

The maximum age at which the loan must be repaid is 65 years old. Apply for a UOB Property Loan online and obtain instant approval 1 within minutes. For resale purchases buyers are required to pay the sellers a deposit in cash of up to 5000.

Loan Amount eg. Whats more receive an additional TANGS gift card worth up to S200 if your home to be financed is. Cash-over-valuation COV must be paid in cash.

Raja I have used capital gain calculator by simple tax India on my 14 years old house in my home town sold for Rs3000000- purchase for Rs 1716092- in 2005. CPF Board policies to note if you bought a resale or DBSS flat. Bring home up to S3499 worth of cash and Apple products inclusive of S2200 in cash for refinancing available exclusively when you apply online.

You can specify up to 3 co-owners in this calculator. Check your loan eligibility by calculating at Max Loan Eligibility Calculator Based on Mortgage Serving Ratio. EC Income Ceiling raised to 16000.

If you need additional help in your housing hunt you can also consult our preferred real estate agents using Ask Guru - or if you a looking for a specialized agent you can search our Agent DirectoryIf you are property owner or agent representing owner therere many property advertising packages that fit your need. 57200 from 1 January 2019. The payment plan for a housing loan provided by a FI is subject to the sole discretion of the FI.

First-timer families may qualify for an Enhanced CPF Housing Grant of up to 80000 while a. The caveat of buying a resale EC is that you wont be eligible for CPF housing grants to help offset the cost. Mortgage Calculator - Compute Loan Still Outstanding at Desired Retirement Age.

UOB Property Loans Online Exclusive. HPS insures members up to age 65 or until the housing loans are paid up whichever is earlier. You must be the flat owner in order to use CPF savings for housing loan payments.

You should budget and plan for your next housing purchase before committing to sell your existing flat. Conditions when taking a second HDB housing loan. The amount of Ordinary Account savings you can use to buy a property depends on your age property type and loan type.

If you are adjusting your HPS cover. For HDB loans its up to 85. A Singapore Government Agency Website.

CPF Basic Retirement Sum. On the other hand the Special Medisave and Retirement Account SMRA interest rates are pegged to the 12-month average yield of 10-year Singapore Government Securities 1. Loan to Value Limit LTV.

If you wish to take up an HDB housing loan to buy a flat confirm your eligibility by applying for an HLE letter. This calculator estimates the monthly instalment payable on a housing loan. Search for flats within your budget by.

The maximum loan repayment period is 25 years. Additionally you can only take a bank loan to finance for the property and must pay at least 25 downpayment for the property assuming that you get the maximum 75 loan amount from the bank of which 5 must be in cash. Its 26 and its calculated this way.

He cited CPF Boards effective interest rate from July-September 2022 has remained at 009 which followed the local banks three-month average interest rate of 009. Calculate the total cost of buying a home how much you can borrow and the amount of cash and CPF you need - then view the homes within your budget. Check your home affordability.

Thats to say the HDB housing loan interest rate can theoretically change if your CPFOA interest rate changes but its well known that these interest rates are unlikely to change. The payment can be a combination of cash and CPF savings. Key your figures into one or both columns.

If you intend to take up a second HDB housing loan to purchase another HDB flat you must use part of your cash proceeds from the sale of the existing flat to pay for your next purchase and reduce your loan amount. Mortgage Servicing Ratio MSR. The grants will be fully credited into an applicants CPF Ordinary Account after flat booking and be used to offset the purchase price of the flat hence lowering the.

CPF Cash Savings. Loan Amount 000 Loan Interest Type Concessionary Rate Term Of Loan in years years Coverage Default 100 100. CPF Basic Healthcare Sum from 1 Jan 2016.

You can also use the Home Loan Calculator to find the best rates for your situation. Conditions when taking a second HDB housing loan. This calculator estimates the monthly instalment payable on a housing loan.

In addition to meeting the above eligibility conditions your second HDB housing loan amount will be reduced by the full CPF refund and part of the cash proceeds from the disposal of the existing or last-owned HDB flat. This refers to the portion of your monthly income that goes towards repaying property loansIts capped at 30 of your monthly. Use of CPF will be prorated based on the extent of the remaining lease of the property can cover the youngest buyer to the age of 95.

The results of this calculator are estimates. What is the HDB housing loan interest rate. This will help buyers set aside CPF savings for their housing needs during retirement eg.

With the online calculator provided by CPF you can find the estimate to the additional interest that you might earn when you do transfer your savings from Ordinary Account to Special Account. For users aged 21-54 the program assumes the loan is repaid by 55. This calculator estimates the premium for a new HPS cover.

Buyer 1 Add Buyer. This promotes financial prudence and prevents over-borrowing. HDB grants CPF housing grants at a glance.

In addition to meeting the above eligibility conditions your second HDB housing loan amount will be reduced by the full CPF refund and part of the cash proceeds from the disposal of the existing or last-owned HDB flat.

The Ultimate Guide To Cpf Accrued Interest Financially Independent Pharmacist

Cpf Board Thinking Of Selling Your First Home When You Do The Cpf Monies You Used To Purchase Your Flat Plus The Accrued Interest Will Be Refunded To Your Cpf Account

Cpfb 3 Differences Between An Hdb Loan And Bank Loan

A Detailed Look Into How Cpf Accrued Interest Affects Your Cash Proceeds Sghousez Com

Cpf Housing Grant Guide For Hdb Flats ᐈ How Much Can I Get

Hdb Valuation How Do I Figure Out How Much An Hdb Flat Is Worth Home Buying Process Premium Calculator The Borrowers

Cpf Accrued Interest Calculator Grid

Is It Smarter To Pay Home Loan Using Cpf Or Cash Youhomesg

Salary Slip Format For Small Organisation Salary Slip Format In Excel Download Free Small Organization Masters In Business Administration Organisation

Should I Pay Down Home Loan Using Cpf Oa

Cpfb 4 Things To Know Before Buying A Hdb Flat

Cpf Savings Vs Cash Which Would Be Better To Use To Pay For Your Home

Buying Your First Home Youtube

Why You Should Not Pay Off Your Mortgage Loan With Your Cpf Oa Value Warrior

Cpf Board Planning To Move Into A 3 Room Or Smaller Flat To Boost Your Retirement Income If You Top Up Your Retirement Account Ra With Your Sale Proceeds You Can Enjoy

Cpf Savings Vs Cash Which Would Be Better To Use To Pay For Your Home

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return